Whether you’re a solopreneur or running a massive corporation, you need a business budget to understand where your money is coming from and going. A business budget template can help keep the numbers organized, making it easy for you to track revenue, plan for expenses, and save for future growth.

You don’t have to be an accountant to organize your business budget. There are thousands of business budget templates out there to make the process easy. Once you understand what a business budget is and how it can work for you, you can use one of the following free templates to start organizing your finances.

The business budget follows a set template, which you can fill in with estimated revenues, plus any recurring or expected business expenses.

For example, if you run a digital marketing business, you might know that you typically make about $10,000 for your work creating campaigns, plus an extra $5,000 for your digital courses. You’d list the estimated revenue from all of your business’ revenue streams as incoming money for the business.

Then, you have your recurring expenses, which you would list as outgoing money. This could include employee salaries, office expenses, and software and technology costs.

How to Create a Business Budget

Creating a business budget is a straightforward process, but it can be more complex for larger companies. Here are the basic steps to creating a business budget.

1. Find a Template or Make a Spreadsheet

There are many free or paid budget templates online these days, so you can either use one of those to start, or make a simple spreadsheet with custom rows and columns based on your business. We list a few helpful templates below.

2. Fill in Revenues

Once you have your template, you’ll start by listing all the sources of your business’ income. With a budget, you’re planning for the future, so you’ll need to estimate this based on previous months’ or years’ revenues. For a new small business budget, you’ll rely on your market research to estimate the first revenues for your company.

3. Subtract Fixed Costs for the Time Period

Fixed costs are the recurring costs you have during each month, quarter, or year. Examples include insurance, rent for office space, website hosting, and internet.

4. Consider Variable Costs

Variable costs will change from time to time. Examples include utility bills, advertising costs, office supplies, and new software or technology. While you may always need to pay some variable costs, like utility bills, you can also shift how much you spend toward things like advertising expenses when you have lower-than-average estimated income.

5. Business Budget Planning

Unexpected expenses might come up, or you might want to save to expand your business. Either way, you need to review your budget after including all expenses, fixed costs, and variable costs to find out how much money you can save. It’s wise to create multiple savings accounts for emergencies and for money meant to go back into the business to drive growth.

How to Manage a Business Budget

There are a few key components to managing your business budget to keep it healthy.

Budget Preparation

The process all starts with properly preparing and planning the budget at the start of each month, quarter, or year. You can also create multiple budgets, some short-term and some long-term. During this stage, you will also set spending limits and create a system to regularly monitor the budget.

Budget Monitoring

For larger businesses, you might delegate budget tracking to multiple supervisors, but even if you are a one-person show, you need to regularly monitor the budget. That means setting a time in your schedule each day or week to review the budget and track actual income and expenses, then compare the actual numbers to the estimates.

Budget Forecasting

With regular budget tracking, you can always know how your business is doing. Check-in regularly to determine how you are doing in terms of revenue, where you have losses, where you can minimize expenses, and how you can move more money into savings. You can use well-tracked budgets to create more accurate budgets for future time periods.

Why is a Budget Important for a Business?

A budget is crucial for businesses. Without one, you could easily be drowning in expenses or unexpected costs compared to incoming money.

The business budget helps with several operations. You can use a business budget to keep track of your finances, save money to help you grow the business or pay bonuses in the future, and prepare for unexpected expenses or emergencies.

You can also review the business budget to determine when to take the next leap for your business. For example, you might be dreaming of a larger office building or the latest software, but you want to make sure you have a healthy net revenue before you make the purchase.

Best Free Business Budget Templates

1. Marketing Budget Template

Knowing how to manage a marketing budget can be a challenge, but with helpful free templates like this marketing budget template bundle, you can track everything from advertising expenses to events and more.

This free bundle includes eight different templates, so you can create multiple budgets to help you determine how much money to put toward marketing plus the return on your investment.

2. Small Business Budget Template

For small businesses, it can be hard to find the time to draw up a budget, but it’s crucial to help keep the business in good health.

Capterra offers a budget template specifically for small businesses. It works with Excel, and you input projections for the year. Then, the spreadsheet will project the month-to-month budget, and you can input your actual revenue and expenses to compare and easily see profits and losses.

3. Startup Budget Template

What if you don’t have any previous numbers to rely on to create profit and expense estimates? If you are a startup, this Gusto budget template will help you draw up a budget before your business is officially in the market. This will help you track all the expenses you need to get your business up and running, estimate your first revenues, and determine where to pinch pennies.

4. Free Business Budget Template

You might be familiar with Intuit, as many companies big and small rely on Intuit’s services like Quickbooks and TurboTax. Even if you don’t use the company’s paid financial services, you can take advantage of Intuit’s free budget template, which works in Google Sheets or Excel.

It features multiple spreadsheet tabs and simple instructions. You enter your revenue in one specific tab and expenses in another. You can also add additional tabs as needed. Then, like magic, the spreadsheet uses the data in the income and expense tabs to summarize the information and even determine net savings and the ending balance.

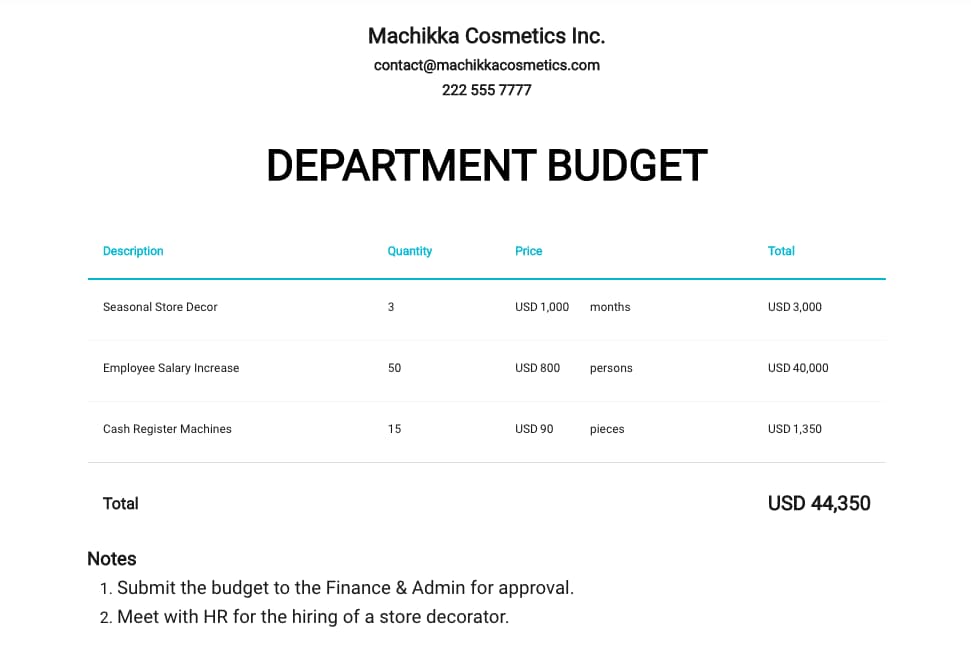

5. Department Budget Sheet

A mid-to large-size company will have multiple departments, all with different budgetary needs. These budgets will all be considered into a massive, company-wide budget sheet, but having a specific template for each department can help teams keep track of spending and plan for growth.

This free template from Template.net works in either document or spreadsheet formats and can help different departments keep track of their income and spending.

Create a Business Budget to Help Your Company Grow

Making your first business budget can be daunting, especially if you have several revenue streams and expenses. But once you get it set up, it’s easy to replicate regularly, and it’s even easier to get started if you have a business budget template to follow.

With a helpful business budget template, a little planning, and regular monitoring, you can plan for the future of your business, including bonuses, new product or service offerings, and expansions.

from Marketing https://blog.hubspot.com/marketing/business-budget-template

Whether you’re a solopreneur or running a massive corporation, you need a business budget to understand where your money is coming from and going. A business budget template can help keep the numbers organized, making it easy for you to track revenue, plan for expenses, and save for future growth.

You don’t have to be an accountant to organize your business budget. There are thousands of business budget templates out there to make the process easy. Once you understand what a business budget is and how it can work for you, you can use one of the following free templates to start organizing your finances.

The business budget follows a set template, which you can fill in with estimated revenues, plus any recurring or expected business expenses.

For example, if you run a digital marketing business, you might know that you typically make about $10,000 for your work creating campaigns, plus an extra $5,000 for your digital courses. You’d list the estimated revenue from all of your business’ revenue streams as incoming money for the business.

Then, you have your recurring expenses, which you would list as outgoing money. This could include employee salaries, office expenses, and software and technology costs.

How to Create a Business Budget

Creating a business budget is a straightforward process, but it can be more complex for larger companies. Here are the basic steps to creating a business budget.

1. Find a Template or Make a Spreadsheet

There are many free or paid budget templates online these days, so you can either use one of those to start, or make a simple spreadsheet with custom rows and columns based on your business. We list a few helpful templates below.

2. Fill in Revenues

Once you have your template, you’ll start by listing all the sources of your business’ income. With a budget, you’re planning for the future, so you’ll need to estimate this based on previous months’ or years’ revenues. For a new small business budget, you’ll rely on your market research to estimate the first revenues for your company.

3. Subtract Fixed Costs for the Time Period

Fixed costs are the recurring costs you have during each month, quarter, or year. Examples include insurance, rent for office space, website hosting, and internet.

4. Consider Variable Costs

Variable costs will change from time to time. Examples include utility bills, advertising costs, office supplies, and new software or technology. While you may always need to pay some variable costs, like utility bills, you can also shift how much you spend toward things like advertising expenses when you have lower-than-average estimated income.

5. Business Budget Planning

Unexpected expenses might come up, or you might want to save to expand your business. Either way, you need to review your budget after including all expenses, fixed costs, and variable costs to find out how much money you can save. It’s wise to create multiple savings accounts for emergencies and for money meant to go back into the business to drive growth.

How to Manage a Business Budget

There are a few key components to managing your business budget to keep it healthy.

Budget Preparation

The process all starts with properly preparing and planning the budget at the start of each month, quarter, or year. You can also create multiple budgets, some short-term and some long-term. During this stage, you will also set spending limits and create a system to regularly monitor the budget.

Budget Monitoring

For larger businesses, you might delegate budget tracking to multiple supervisors, but even if you are a one-person show, you need to regularly monitor the budget. That means setting a time in your schedule each day or week to review the budget and track actual income and expenses, then compare the actual numbers to the estimates.

Budget Forecasting

With regular budget tracking, you can always know how your business is doing. Check-in regularly to determine how you are doing in terms of revenue, where you have losses, where you can minimize expenses, and how you can move more money into savings. You can use well-tracked budgets to create more accurate budgets for future time periods.

Why is a Budget Important for a Business?

A budget is crucial for businesses. Without one, you could easily be drowning in expenses or unexpected costs compared to incoming money.

The business budget helps with several operations. You can use a business budget to keep track of your finances, save money to help you grow the business or pay bonuses in the future, and prepare for unexpected expenses or emergencies.

You can also review the business budget to determine when to take the next leap for your business. For example, you might be dreaming of a larger office building or the latest software, but you want to make sure you have a healthy net revenue before you make the purchase.

Best Free Business Budget Templates

1. Marketing Budget Template

Knowing how to manage a marketing budget can be a challenge, but with helpful free templates like this marketing budget template bundle, you can track everything from advertising expenses to events and more.

This free bundle includes eight different templates, so you can create multiple budgets to help you determine how much money to put toward marketing plus the return on your investment.

2. Small Business Budget Template

For small businesses, it can be hard to find the time to draw up a budget, but it’s crucial to help keep the business in good health.

Capterra offers a budget template specifically for small businesses. It works with Excel, and you input projections for the year. Then, the spreadsheet will project the month-to-month budget, and you can input your actual revenue and expenses to compare and easily see profits and losses.

3. Startup Budget Template

What if you don’t have any previous numbers to rely on to create profit and expense estimates? If you are a startup, this Gusto budget template will help you draw up a budget before your business is officially in the market. This will help you track all the expenses you need to get your business up and running, estimate your first revenues, and determine where to pinch pennies.

4. Free Business Budget Template

You might be familiar with Intuit, as many companies big and small rely on Intuit’s services like Quickbooks and TurboTax. Even if you don’t use the company’s paid financial services, you can take advantage of Intuit’s free budget template, which works in Google Sheets or Excel.

It features multiple spreadsheet tabs and simple instructions. You enter your revenue in one specific tab and expenses in another. You can also add additional tabs as needed. Then, like magic, the spreadsheet uses the data in the income and expense tabs to summarize the information and even determine net savings and the ending balance.

5. Department Budget Sheet

A mid-to large-size company will have multiple departments, all with different budgetary needs. These budgets will all be considered into a massive, company-wide budget sheet, but having a specific template for each department can help teams keep track of spending and plan for growth.

This free template from Template.net works in either document or spreadsheet formats and can help different departments keep track of their income and spending.

Create a Business Budget to Help Your Company Grow

Making your first business budget can be daunting, especially if you have several revenue streams and expenses. But once you get it set up, it’s easy to replicate regularly, and it’s even easier to get started if you have a business budget template to follow.

With a helpful business budget template, a little planning, and regular monitoring, you can plan for the future of your business, including bonuses, new product or service offerings, and expansions.

No hay comentarios:

Publicar un comentario